TBMC 2025 signaled a turning point for enterprise leaders working to align strategy, spend, and execution. The energy in Miami made one thing unmistakable: TBM is accelerating beyond its roots, and the enterprises driving the most meaningful impact are the ones evolving their operating models around value flow, AI-first execution, and connected financial governance.

This year’s conference surfaced a unified message across hundreds of conversations, sessions, and forums. Enterprises are moving faster. The pressure for financial clarity is rising. And leaders want a more adaptive, outcome-oriented model for decisions that affect every corner of the business. TBM sits at the center of that shift, and TBM Framework 5.01 emerged as the catalyst.

Below is a clear view of the themes that shaped TBMC 2025 and what they mean for organizations building toward the next generation of operating discipline.

TBM Framework 5.01: the most significant update in years

The headline announcement reverberated across the entire event: TBM Framework 5.01 launches January 1. This update introduces a more modern, accessible, and value-focused version of TBM and reflects the changing demands of enterprise operations.

The shift is more than cosmetic. Leaders responded strongly to the new emphasis on value drivers rather than data mechanics, a notable realignment that gives organizations a clearer starting point and a faster path to meaningful outcomes.

Key elements of TBM 5.01 that stood out to attendees

- Streamlined certification, replacing outdated programs with a more modern, practical approach.

- Practical adoption guidance, including how to start implementing the framework in 30 days—something practitioners have requested for years.

- More digestible onboarding materials for new adopters, reducing the learning curve historically required.

- Published knowledge artifacts, replacing the tacit, community-driven guidance that previously filled the gaps in documentation.

These changes significantly lower the barrier for adoption while presenting new opportunities for teams ready to mature into a more sophisticated TBM practice.

Yet the excitement came with a dose of realism. Many attendees said the pace of change feels fast. As organizations prepare to adopt the new materials, interest in structured learning, advisory support, and TBM-aligned assessments surged. Leaders understand the value of the new framework; now they want a clear roadmap for approaching it with confidence.

AI-first transformation, enterprise architecture, and value orchestration dominated the event

While TBM 5.01 was the biggest announcement, the broader conversation revealed deeper shifts in how organizations plan to run.

AI-first expectations drove the transformation dialogue

Across sessions and informal discussions, enterprise leaders focused on the same goal: use AI to close execution gaps and bring decision velocity closer to real time. Many described AI as the missing mechanism that links TBM insights to operational change.

The appetite was strong, but grounded. Leaders want AI applied with purpose, not novelty. They want to accelerate forecasting, strengthen investment choices, and automate the mechanics that slow down strategic execution.

Enterprise architecture returned to center stage

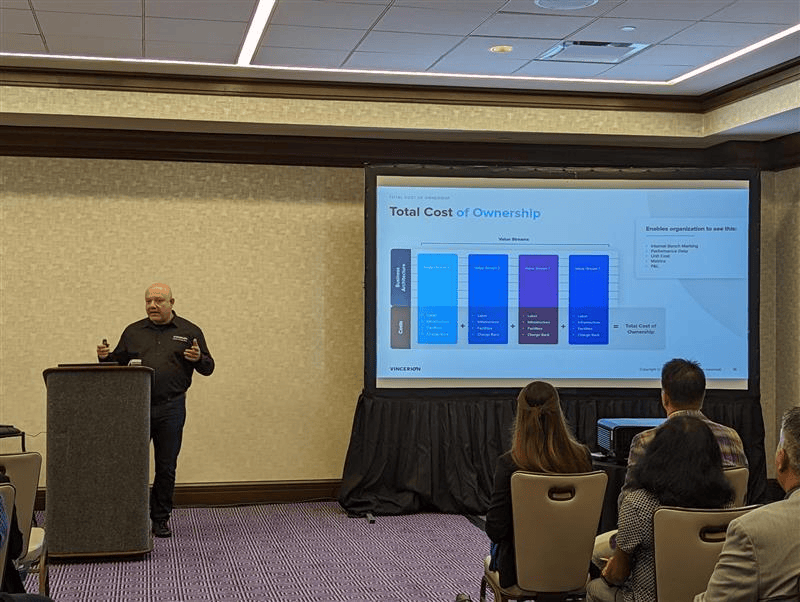

EA sessions drew sustained interest across the conference. Leaders are recognizing that enterprise architecture—when paired with TBM and modern portfolio practices—becomes a driver of value flow instead of a gatekeeper. Conversations centered around:

- Breaking architecture into clear delivery streams

- Integrating architecture earlier in decision cycles

- Using EA to modernize platforms and prepare for AI-first operations

The message landed well: EA is no longer about standards alone. It is part of the machinery of value creation.

See this in action with the story of a leading international airline that gained the visibility needed to accelerate decisions, reduce friction, and operate with greater strategic confidence.

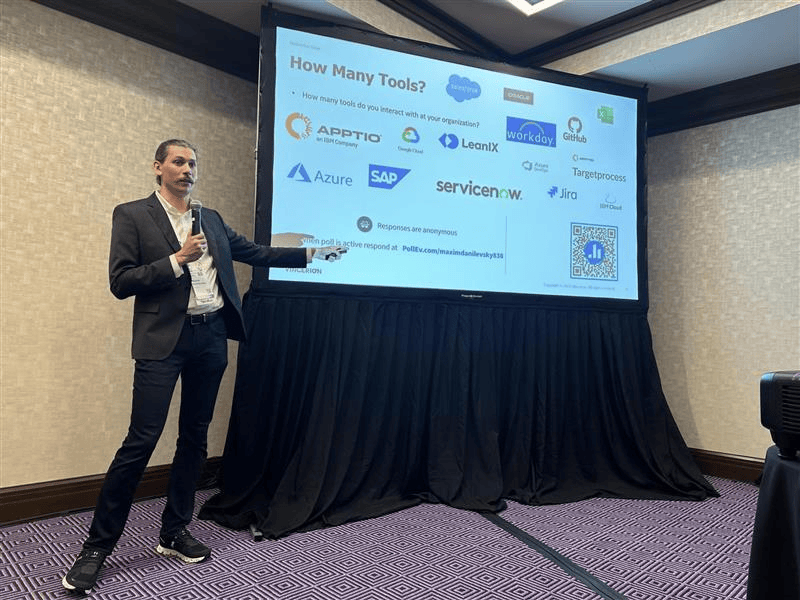

Tool-agnostic TBM gained meaningful momentum

In hallway conversations and booth discussions, a clear trend emerged. Many organizations evaluating TBM practices are moving toward tool-agnostic approaches. Some attendees were not using Apptio at all. Others were exploring more flexible or cost-efficient platforms. The industry is shifting toward TBM as a discipline, not a product. Leaders want adaptability without sacrificing structure.

Executive alignment remains both critical and challenging

CFOs and CIOs increasingly share ownership of investment governance, value realization, and performance visibility. Yet many leaders acknowledged ongoing uncertainty about how to activate that partnership inside their operating model. Interest in clearer governance patterns and dynamic funding mechanisms was strong throughout the event.

The call for real examples was louder than ever

One theme rose consistently above all others: leaders want to learn from real journeys, not just frameworks.

Case-based sessions filled quickly. Attendees gravitated toward stories that revealed patterns, mistakes, and practical ways to navigate complexity.

The appetite for clarity was unmistakable. Organizations want guidance they can act on, rooted in real enterprise behavior, not only theoretical best practices. This reinforces the increasing demand for advisory interaction, working sessions, and diagnostic assessments.

Cprime’s presence and perspective made an impact

Cprime’s voice resonated strongly throughout TBMC 2025, and the response validated the central role of the Enterprise Operating Model in powering TBM effectiveness.

High engagement across our ten sessions

Our sessions on TBM, enterprise finance, portfolio performance, architecture, and operating model design consistently drew strong attendance. Leaders gravitated toward the intersection of TBM and the operating model: how decisions accelerate when financial governance, architecture, strategy, and delivery operate as a connected system.

Industry recognition: Apptio’s Americas SPM Partner of the Year

Cprime received Apptio’s Americas SPM Partner of the Year award, underscoring the measurable value organizations are achieving through our TBM and SPM engagements. The award reflects the momentum behind outcome-based operating model transformation and reinforces our role in shaping the next chapter of this discipline.

Strong alignment with market needs

Every conversation we had at TBMC pointed toward the same conclusion: enterprises are ready for a more connected approach to TBM that integrates strategy, financial governance, architecture, portfolio decisions, and AI-first execution into a cohesive operating model.

What 5.01 means for enterprises moving forward

TBM 5.01 marks a shift toward simplicity, clarity, and value. The implications for enterprise leaders are significant.

For organizations beginning their TBM journey: the new guidance accelerates early adoption by providing clearer starting points and structured materials. Teams can apply TBM with greater consistency, confidence, and alignment from day one.

For maturing practitioners: 5.01 encourages a deeper look at value drivers, costing models, and governance practices. Assessments and maturity analysis will become essential as teams refine how TBM shapes financial and operational decisions.

For enterprises building AI-first operating models: TBM becomes the economic intelligence layer that powers real-time planning, prioritization, and value flow. AI-first execution demands a clear understanding of how capital, capacity, and outcomes move across the enterprise. TBM strengthens that foundation.

How Cprime is helping leaders navigate the 5.01 era

As TBM evolves, enterprises benefit from clear guidance and a structured path that helps them apply the new framework with confidence. We’re helping organizations accelerate momentum through:

TBM 5.01 learning and enablement: Training and education designed to make the new framework accessible, actionable, and tied directly to enterprise priorities.

Certification preparedness: Support for teams navigating the modernized certification process and building foundational fluency in TBM 5.01.

TBM assessments: Diagnostic assessments to evaluate maturity, identify gaps, and highlight the highest-impact areas for improvement, aligned to both 5.01 and Enterprise Operating Model practices.

Integration into the Enterprise Operating Model: TBM strengthens the connective tissue of the EOM, linking strategy, investment decisions, architecture, and execution. Our operating model solutions help leaders build systems where TBM becomes part of the enterprise’s ongoing rhythm.