In the dynamic landscape of modern business, the strategic allocation of resources stands as a cornerstone of success. This is where Participatory Budgeting (PB) within Lean Portfolio Management (LPM) comes into play, offering a transformative approach to how organizations manage and allocate their resources. Distinct from traditional project-based funding methods, PB pivots the focus towards the broader concept of value streams.

This approach marks a significant shift from funding specific projects to investing in the capacity to perform work. In essence, it’s not just about financing individual tasks or initiatives; it’s about empowering the entire process that delivers value to the business. This strategy ensures a more holistic view of resource allocation, one that aligns closely with the organization’s long-term goals and agile principles.

Running the business vs. growing the business

At the heart of this methodology is the categorization of the portfolio budget into two key areas: ‘running the business’ and ‘growing the business.’ This delineation enables organizations to balance the maintenance of current operations with the pursuit of new opportunities and innovations. The ‘running the business’ aspect ensures operational stability, while the ‘growing the business’ facet opens doors to new ventures, technologies, and strategies that propel the company forward.

PB and cross-functional teams

A vital aspect of PB in LPM is the active involvement of cross-functional teams in the decision-making process. These teams, composed of diverse professionals from various departments, collaborate to provide comprehensive insights into the funding decisions. Their input is crucial in shaping the final decisions made by LPM leaders, ensuring that a wide range of perspectives and expertise are considered. This collaborative approach not only democratizes the decision-making process but also ensures that the outcomes are well-aligned with the organization’s strategic objectives and market demands.

By embracing PB within LPM, businesses can achieve a more agile, responsive, and strategic approach to budgeting and resource allocation. This methodology not only aligns financial investments with corporate strategy but also fosters a culture of collaboration, innovation, and continuous improvement.

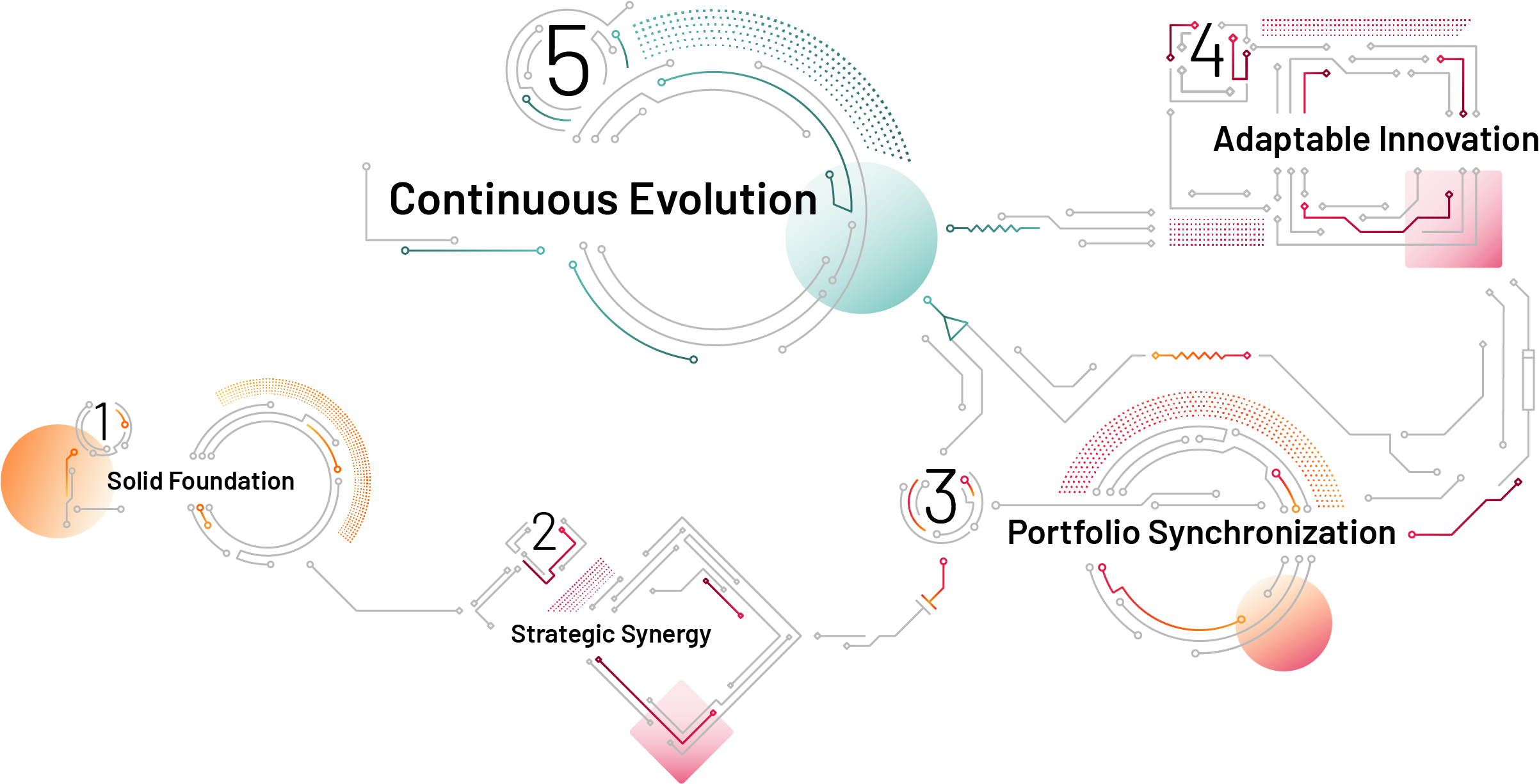

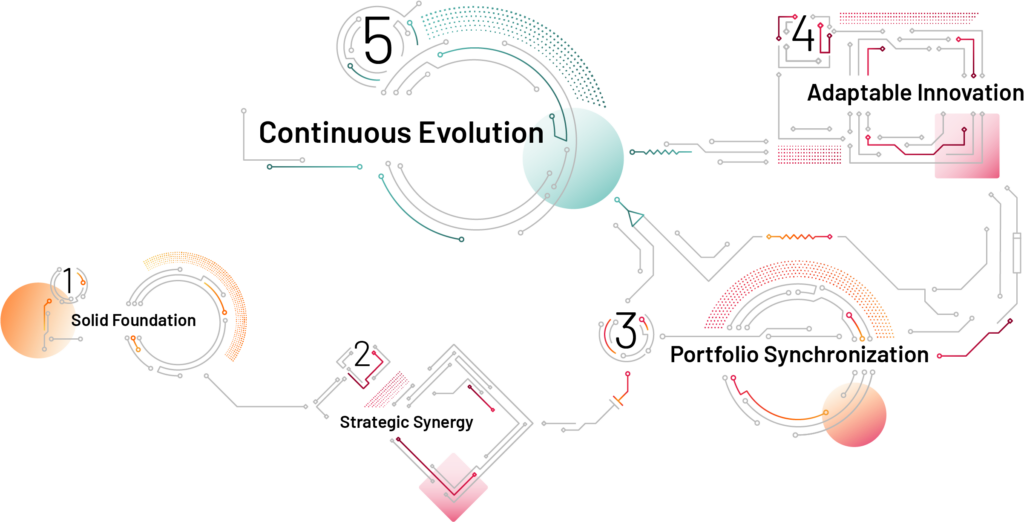

Prerequisites for Implementing Participatory Budgeting

The successful implementation of PB in LPM hinges on certain prerequisites that organizations must fulfill. These prerequisites ensure that the PB process is grounded in a solid foundation, capable of delivering its intended benefits.

Understanding development value streams

First and foremost, a clear understanding of the organization’s development value streams is crucial. These value streams represent the various pathways through which the organization delivers value to its customers. Knowing what these value streams are and how they operate is fundamental to applying PB effectively. This understanding allows for a more targeted and strategic allocation of resources, ensuring that funding is directed towards areas that generate the most value.

Availability of data

Another critical prerequisite is the availability of data that informs the PB process. This includes information on the capacity of the development value streams and how this capacity is consumed by different types of work. Having this data at hand makes the PB process more data-driven and objective, enabling informed decision-making. In the absence of such data, the process can become subjective and less effective, often leading to decisions based on perceived needs rather than actual strategic priorities.

Conducive organizational structure

Furthermore, the organizational structure must be conducive to the PB approach. This means having well-defined, stable teams and Agile Release Trains (ARTs) aligned with the value streams. If an organization is still operating under a project-based structure, with teams being formed and disbanded for individual projects, the full potential of PB cannot be realized. The essence of PB is to fund capacity and value streams rather than discrete projects, and this requires a stable organizational structure with long-term, dedicated teams.

Conducive culture

In addition to structural readiness, cultural readiness is equally important. The organization must cultivate a culture that embraces the principles of agility and lean thinking, which are at the core of LPM and PB. This involves fostering a mindset that values collaboration, flexibility, and continuous improvement. Training and coaching can play a significant role in preparing the organizational culture for this shift.

Conducive circumstances

Lastly, it’s essential to consider whether the organization’s current stage and circumstances make it a suitable candidate for PB. Not every organization or situation warrants the implementation of PB. Factors such as the size of the organization, the complexity of its operations, and its strategic objectives should be taken into account when deciding whether to adopt PB.

The prerequisites for implementing PB in LPM include a thorough understanding of value streams, availability of relevant data, appropriate organizational structure, cultural readiness, and situational suitability. By ensuring that these conditions are met, organizations can lay a strong foundation for a successful PB implementation.

Integrating Strategic Themes and OKRs with Participatory Budgeting

Integrating Strategic Themes and Objectives and Key Results (OKRs) into the PB process is a critical step in ensuring that budgeting decisions are closely aligned with an organization’s strategic goals. This integration provides a clear framework for translating high-level objectives into actionable and measurable financial plans, enhancing the effectiveness of PB within LPM.

Strategic themes

Strategic Themes represent the essential business imperatives that drive an organization’s decision-making process. These themes, which are typically broad and encompass the organization’s long-term goals, set the stage for the kind of projects and initiatives that should be prioritized in the PB process. By aligning budgeting decisions with these strategic themes, organizations ensure that their investments are directed towards areas that will have the most significant impact on achieving their overarching objectives.

OKRs

OKRs come into play as a tool for operationalizing these strategic themes. OKRs are specific, measurable, and time-bound objectives that articulate what an organization aims to achieve and how it plans to get there. In the context of PB, OKRs provide a clear set of criteria against which proposed projects and initiatives can be evaluated. They help in assessing whether a particular investment will contribute to the strategic themes and objectives of the organization.

During the PB process, participants use these OKRs to evaluate the potential value of different epics or initiatives. This evaluation is based on how well these projects align with the strategic themes and whether they are likely to achieve the key results defined in the OKRs. This approach enables decision-makers to prioritize projects that are not only financially viable but also strategically relevant, ensuring that every investment is a step towards fulfilling the organization’s strategic vision.

Moreover, the use of OKRs in PB helps in maintaining transparency and accountability. Since OKRs are specific and measurable, they provide a clear benchmark for evaluating the success of investments post-implementation. This feature of OKRs is particularly beneficial in creating a culture of continuous improvement, where learnings from past investments are used to refine future budgeting decisions.

Integrating strategic themes and OKRs into the PB process is a powerful way to ensure that budgeting decisions are not made in isolation but are a part of a strategic framework aimed at driving long-term success and sustainability.

Conducting Participatory Budgeting Events Across Value Streams

Conducting PB events across different value streams is a critical aspect of implementing PB in LPM. This approach, while offering numerous benefits, also presents unique challenges that need careful consideration to ensure effective and balanced budget allocation.

One of the primary considerations in running PB events across various value streams is the necessity of having a comprehensive, holistic view of all investment opportunities. This comprehensive perspective is crucial because it allows decision-makers to understand and evaluate the interdependencies and relative importance of initiatives across different areas of the business. Running PB events in isolation for each value stream, although seemingly more manageable, can lead to a fragmented approach where the broader strategic objectives of the organization might not be adequately addressed.

For instance, conducting PB events asynchronously – separated by time or conducted independently for each value stream – poses the risk of a skewed allocation of resources. The first value streams to undergo the PB process might consume a disproportionate share of the budget, leaving subsequent streams with limited resources. This uneven distribution can result in suboptimal investment decisions that do not reflect the organization’s overall strategic priorities.

To mitigate this risk, it is advisable to conduct PB events in a manner that encompasses all value streams concurrently. This approach ensures that all potential investments are considered together, allowing for a balanced assessment of where resources should be allocated for maximum impact. It fosters a collaborative environment where representatives from different value streams can discuss, negotiate, and align their priorities with the overarching goals of the organization.

Moreover, integrating value streams in PB events promotes a culture of transparency and collective decision-making. It encourages cross-functional collaboration, enabling participants to gain insights into the challenges and opportunities across the organization. This collaborative approach not only leads to more informed budgeting decisions but also builds a shared understanding of the organization’s strategic direction.

Conducting PB events across value streams is a delicate balancing act that requires a holistic view of the organization’s goals and priorities. It demands careful planning and coordination to ensure that all value streams are represented equitably, and their needs and contributions are appropriately considered in the budgeting process.

Scaling Participatory Budgeting to the Enterprise Level

Scaling PB from individual portfolios to the enterprise level is a strategic maneuver that significantly amplifies its impact across the entire organization. This expansion is not just a matter of increasing the scale but involves a deliberate shift in focus towards overarching strategic themes and enterprise epics. By doing so, PB transcends the confines of portfolio-specific concerns, aligning financial decision-making with the broader objectives and vision of the organization.

At the enterprise level, PB becomes a powerful tool for translating high-level strategic themes into actionable financial plans. These themes, which encapsulate the organization’s primary goals and aspirations, guide the allocation of resources across various portfolios. The process ensures that the distribution of the budget is in harmony with the strategic direction of the enterprise, thereby maximizing the potential for achieving desired outcomes.

Review portfolio budgets

In practical terms, scaling PB to this level involves a comprehensive review of the enterprise’s portfolio budgets. This review assesses how these budgets can be best allocated to fulfill the strategic themes. For instance, in a multinational corporation, this might mean balancing investments across diverse geographical markets, product lines, or business units, ensuring that each area receives funding proportionate to its role in achieving the strategic objectives.

Analyze enterprise epics

Moreover, this scaled approach often involves analyzing enterprise epics that span multiple portfolios. These epics, which represent significant initiatives or projects with broad implications, are critical in determining how resources should be distributed to support the enterprise’s long-term goals. By focusing on these epics, PB at the enterprise level ensures a cohesive and integrated approach to budgeting, one that aligns individual portfolio decisions with the overarching strategy of the organization.

The move to implement PB at the enterprise level is more than a budgeting exercise; it’s a strategic initiative that fosters alignment, clarity, and focus across all levels of the organization. It allows senior leaders to make informed decisions about where to invest in order to drive innovation, efficiency, and growth, ensuring that every dollar spent is an investment in the future of the enterprise.

Navigating Challenges in Participatory Budgeting and Portfolio Management

Implementing PB in LPM comes with its own set of challenges that organizations must navigate to fully reap its benefits. Understanding and addressing these challenges is key to ensuring a smooth and effective PB process.

Creating a comprehensive portfolio of work items

One of the primary challenges in PB is the creation of a comprehensive portfolio of work items. Organizations often find that their portfolio lacks a detailed and holistic view of both ongoing projects (work in progress) and potential future projects (work in the backlog). This deficiency can lead to a fragmented understanding of the organization’s initiatives, where projects or epics are viewed in isolation rather than as parts of a larger strategic plan. Moreover, there is often a tendency to see projects or epics as just large groups of features without a clear understanding of their broader impact or alignment with strategic objectives.

Defining project scope and value

Another significant challenge is defining the scope and value of projects accurately. Many organizations struggle to quantify the expected value or outcomes of their initiatives, making it difficult to prioritize investments effectively during the PB process. This lack of clarity can lead to suboptimal allocation of resources, where investments are made in projects with uncertain returns or minimal strategic relevance.

Misalignment of budget cycles and value

Additionally, the misalignment of annual budgeting cycles with the actual value and timing of work can hinder the effectiveness of PB. Traditional budgeting processes are often rigid and do not align well with the dynamic and agile nature of PB. This misalignment can lead to situations where funding decisions are made based on outdated or irrelevant information, leading to inefficiencies and missed opportunities.

To overcome these challenges, organizations need to invest time and resources in developing a well-structured and detailed portfolio. This involves not only listing all projects and initiatives but also clearly defining their scope, expected outcomes, and strategic relevance. It also requires a shift in mindset from traditional annual budgeting to a more agile and responsive approach that aligns with the principles of PB and LPM.

Furthermore, addressing these challenges involves ensuring that all stakeholders, including project managers, finance teams, and strategic planners, are aligned and working collaboratively. This alignment is crucial for creating a shared understanding of the organization’s strategic objectives and how the PB process can help achieve them.

By proactively addressing these challenges, organizations can enhance the effectiveness of their PB processes, leading to better alignment of resources with strategic goals and ultimately driving improved business outcomes.

Addressing Organizational Fears and Readiness for Participatory Budgeting

Adopting PB within LPM often requires significant organizational change, which can lead to apprehension and resistance among stakeholders. Addressing these fears and ensuring readiness for PB is crucial for a successful implementation.

Alleviating fear of the unknown

One of the primary concerns in organizations transitioning to PB is the fear of the unknown, particularly regarding changes in funding mechanisms and decision-making processes. This apprehension can be mitigated through effective communication and education. It’s important to articulate the benefits of PB, such as increased transparency, strategic alignment, and collaborative decision-making. Organizations should provide clear information on how PB works, what changes it will bring, and how these changes will benefit both the organization and its individual members.

Senior management plays a vital role in alleviating these fears. Their involvement and endorsement of PB can reassure employees that the change is strategic and supported at the highest level. Demonstrating executive buy-in can significantly enhance the acceptance and adoption of PB across the organization.

The value of one-on-one coaching

Additionally, one-on-one coaching sessions can be highly effective in managing fears and resistance. These sessions offer a platform for stakeholders to voice their concerns, ask questions, and receive personalized guidance on how PB will affect their roles and responsibilities. This individual attention helps in building trust and confidence in the PB process.

Addressing culture and processes

Another critical aspect of preparing for PB is ensuring that the organization’s culture and processes are aligned with the principles of PB. This may involve training teams on agile and lean principles, which are foundational to LPM and PB. Training should focus not only on the technical aspects of PB but also on the mindset shift required for a more collaborative and dynamic approach to budgeting and resource allocation.

Organizations should also assess their readiness in terms of data availability and systems. Successful PB requires accurate and up-to-date information about projects, resources, and strategic priorities. Ensuring that this information is readily available and reliable is key to informed decision-making in PB events.

Preparing for PB involves a combination of strategic communication, senior management involvement, personalized coaching, cultural alignment, and data readiness. By addressing fears and building a strong foundation for PB, organizations can facilitate a smoother transition and maximize the benefits of this innovative approach to portfolio management.

Real-World Application of Participatory Budgeting

The real-world application of PB in LPM is exemplified through its implementation in a multinational data and analytics organization. This case study provides a practical perspective on how PB can be effectively utilized to enhance organizational performance and strategic alignment.

In this organization, PB was adopted as a key tool for achieving transparency across various projects and initiatives. One of the primary goals was to match the supply of development value streams with the demand for them. By doing this, the organization could align its resources with the most valuable work, ensuring that efforts were concentrated where they would generate the most significant impact.

A significant outcome of this approach was the ability to make informed trade-offs. PB facilitated structured conversations about priorities, enabling decision-makers to weigh the potential benefits of different projects against each other. This process was instrumental in focusing the organization’s energy and resources on the initiatives that promised the highest returns, both in terms of financial gains and strategic advancement.

Another notable benefit was the transparency that PB brought to the table. It provided a clear view of all ongoing and planned work, as well as the capacity of different development value streams. This visibility was crucial in making informed decisions about where to allocate resources, eliminating the guesswork and assumptions that often accompany traditional budgeting processes.

Moreover, the alignment achieved through PB helped the organization to limit its work in progress effectively. By prioritizing and focusing on the most important projects, the company could avoid overextension and ensure that its teams were not spread too thin across multiple initiatives. This focus also meant that resources were not wasted on lower-priority projects that did not align with the core strategic objectives.

The implementation of PB in this organization underscores its effectiveness in enhancing strategic alignment, improving resource allocation, and driving better decision-making. By adopting a participatory approach to budgeting, the company was able to harness the collective expertise of its teams, leading to more informed and impactful financial decisions.

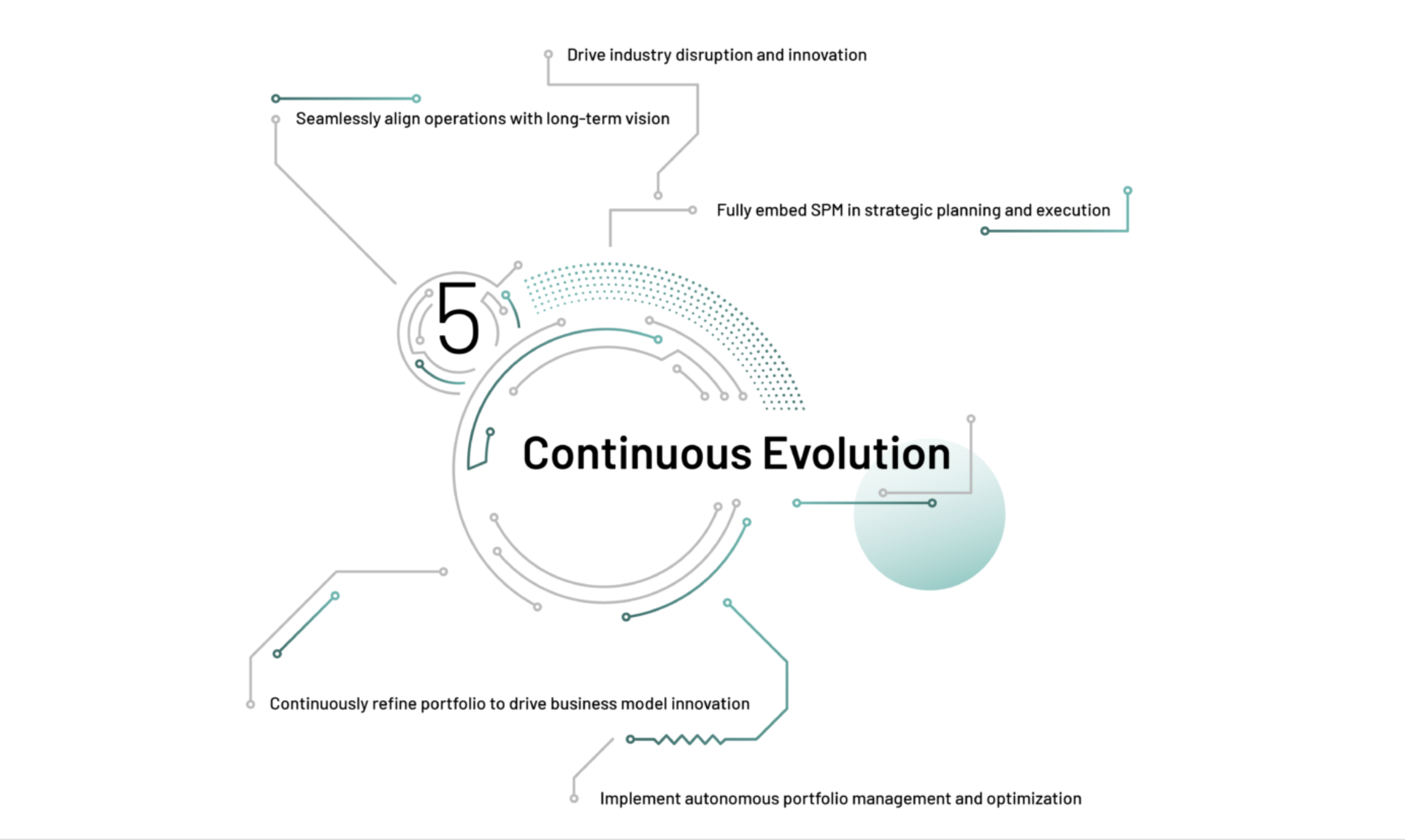

Embracing Participatory Budgeting in Your LPM Journey

As organizations embark on their LPM journey, embracing PB can mark a significant step towards achieving strategic alignment and enhanced resource optimization. However, successful implementation of PB requires thoughtful preparation, a clear understanding of its principles, and a commitment to cultural change.

To conclude, here are key pieces of advice and recommendations for organizations considering the adoption of PB within their LPM framework:

- Emphasize Preparation and Planning: Just like any major organizational change, the transition to PB demands thorough preparation. This includes aligning stakeholders, ensuring data readiness, and understanding the intricacies of your organization’s value streams. Preparation is not just about logistical readiness but also involves setting the stage for a cultural shift towards a more collaborative and agile approach to budgeting.

- Foster a Culture of Agility and Collaboration: PB thrives in an environment where agility and collaboration are valued. Encourage open communication, cross-functional teamwork, and a mindset of continuous improvement. This cultural shift is fundamental to reaping the full benefits of PB.

- Engage and Educate Stakeholders: Address potential resistance by engaging stakeholders at all levels. Educate them about the benefits of PB, how it works, and what changes it will bring. Clear, transparent communication can alleviate fears and build support for the new approach.

- Leverage Senior Management Support: Having the backing of senior management is critical. Their support can lend credibility to the PB initiative and drive home its importance as a strategic tool within the organization.

- Start with a Pilot Program: If uncertain about the full-scale implementation of PB, consider starting with a pilot program. This can provide valuable insights and learnings that can inform a broader rollout.

- Regularly Review and Adapt: PB is not a set-and-forget process. Regular reviews and adaptations based on feedback and outcomes are essential. This iterative approach ensures that the PB process remains aligned with the evolving needs and goals of the organization.

- Measure and Celebrate Success: Establish metrics to measure the success of PB initiatives. Celebrate achievements and learnings, both big and small, to maintain momentum and reinforce the value of PB within the organization.

Participatory Budgeting represents more than just a budgeting technique; it is a strategic tool that can transform how organizations align their resources with their strategic goals.

For those interested in exploring PB further, we recommend watching the webinar on demand, LPM in Practice: Participatory Budgeting with SAFe CoFund. This resource offers a comprehensive overview of PB, providing deeper insights and practical examples of how it can be effectively implemented within the LPM framework, including the use of a new application from Scaled Agile, Inc. Embrace the journey of PB to unlock new levels of strategic alignment and resource optimization in your organization.