Strategic Portfolio Management: Your Operating Model’s Missing Link

Despite years of transformation investment, too many enterprises are still falling short of measurable outcomes. Why? Because their operating models are missing the connective tissue between strategic intent and real-world execution. That missing link is strategic portfolio management (SPM).

SPM functions as the mechanism that aligns enterprise-wide priorities with capacity, funding, and measurable value, turning static strategies into compounding results.

What Is Strategic Portfolio Management?

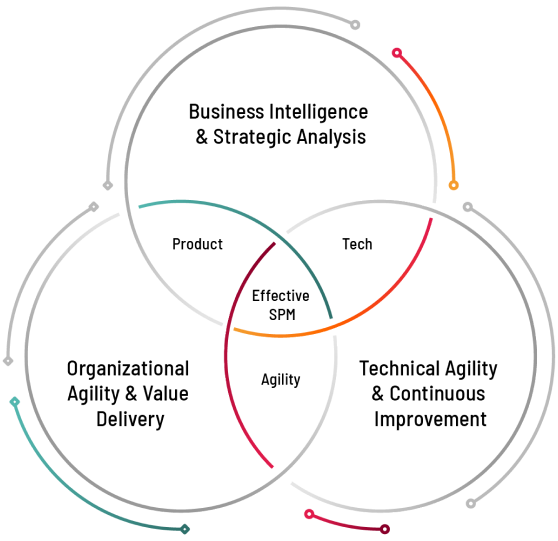

Strategic portfolio management is a value optimization discipline that dynamically connects what the business wants to achieve with how it gets done. It links strategic intent to execution reality, enabling leaders to govern investment, reprioritize based on market shifts, and ensure resources flow to what creates the greatest impact.

Far from traditional project oversight, SPM governs decision-making across initiatives. It unifies strategy, funding, and delivery into one system of value creation—an essential component of any modern enterprise operating model.

And as enterprises face increasing pressure to move faster with fewer resources, the need for this system has never been more urgent. According to Deloitte, 51% of global leaders say their digital initiatives target fundamental change, yet only 32% report significant enterprise value. That gap is where portfolio discipline makes the difference.

Why Traditional Planning Fails to Deliver Outcomes

Most enterprises still treat strategy, investment, and execution as separate conversations. Budgets are locked months before delivery teams can weigh in. Capacity constraints derail even the best-laid plans. And market shifts often expose how out of sync the roadmap is with what actually creates value.

Outcomes stall, not because teams fail to deliver but because priorities were never aligned to begin with.

Common Signs of Misalignment:

- Multiple “priority” initiatives competing for the same resources

- Delays caused by unclear ownership or overlapping scopes

- Value metrics defined after the fact (if at all)

- Static roadmaps that can’t adjust to real-time market signals

These symptoms point to a structural issue: the absence of enterprise-wide orchestration. Strategic portfolio management rewires the system so strategy and execution move in concert.

How Portfolio Management Strengthens Your Operating Model

A modern operating model is a dynamic system that integrates strategy, funding, and execution. SPM is the control center of that system. It gives leaders visibility into how value flows and where it gets blocked. It also provides the mechanisms to adapt in real time, reallocating investments, shifting resources, and reinforcing enterprise priorities across every domain.

Connecting Funding, Execution, and Measurable Value

Strategic portfolio management:

- Ties funding directly to business objectives, enabling investment to follow value

- Matches work intake with actual capacity, avoiding burnout and delays

- Makes trade-offs explicit through scenario modeling and performance insights

- Surfaces opportunities to reduce redundancy, align dependencies, and accelerate time to value

Through 2024, this shift has gained momentum. As Broadcom notes, leading organizations are moving away from turnkey toolsets toward tailored approaches, blending agile, traditional, and SAFe-based frameworks to prioritize investment performance over engineering efficiency.

KPIs That Matter: Measuring What Your Transformation Actually Delivers

SPM elevates performance measurement from status reporting to strategic feedback. It builds a discipline around the KPIs that matter most to business stakeholders:

- Customer retention and net revenue retention

- Time-to-value acceleration

- Margin expansion or cost avoidance

- Reinvestment yield and strategic agility

And as AI begins to infuse portfolio operations, measurement is getting sharper. The Forbes Tech Council dubbed this evolution “Strategic Portfolio Management 2.0”, where generative AI enhances scenario planning, demand management, and real-time KPI optimization.

Getting Started: Aligning Priorities with Real-World Capacity

Organizations can start by building on what they already know and clarifying how those insights align with their most critical goals.

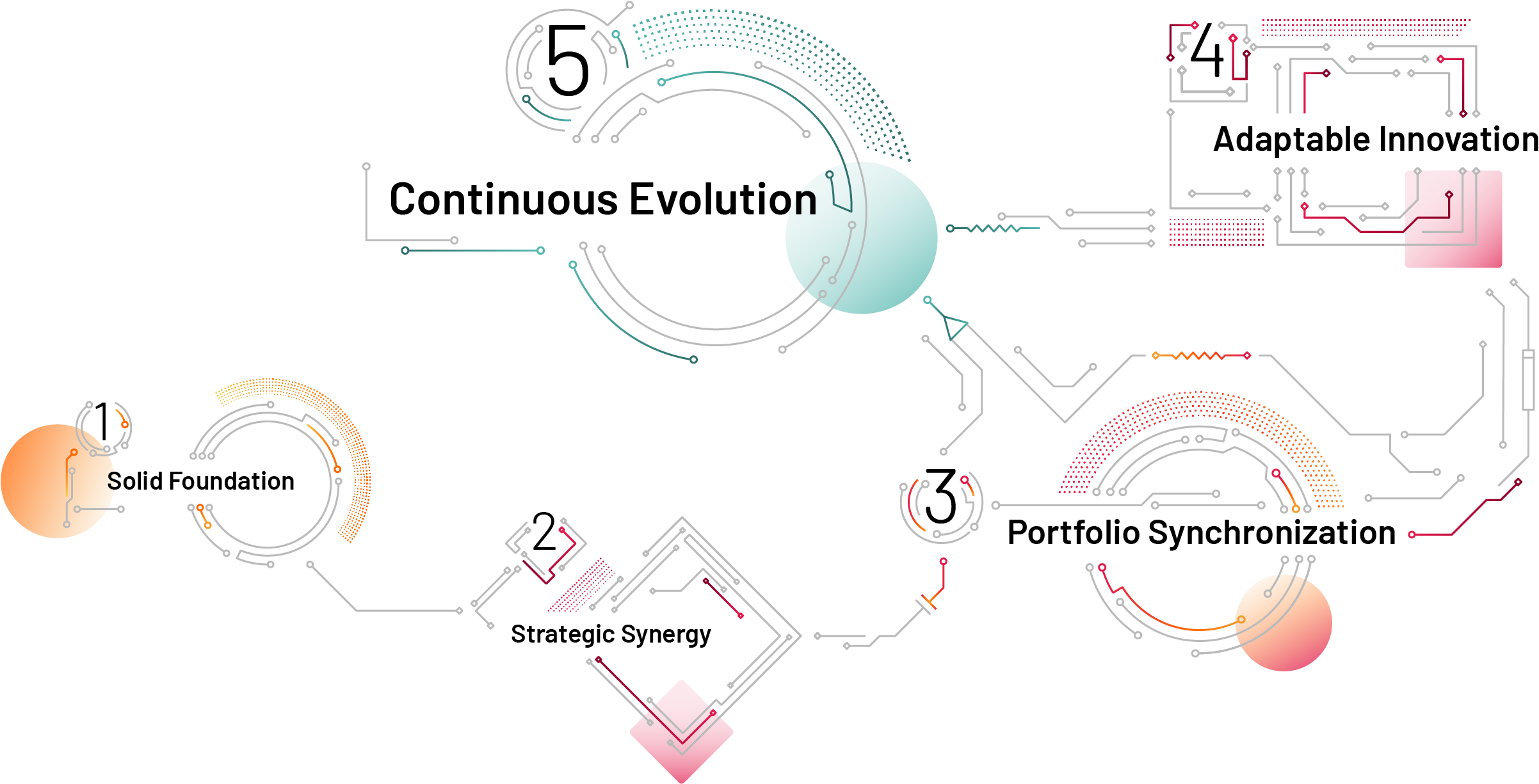

To embed SPM into the operating model:

- Map how strategy flows through funding to delivery, and pinpoint where it breaks.

- Establish a cross-functional governance rhythm to review and adjust portfolio priorities regularly.

- Align prioritization criteria to business value, not just internal politics or sunk cost.

- Equip leaders with visibility into resource constraints, interdependencies, and outcomes in motion.

Strategic portfolio management serves as a core operating capability, a way to orchestrate the enterprise around the outcomes that matter most, going beyond dashboards and meetings. Once in place, it becomes the link that turns ambition into advantage.